Let Us Take the Stress Out of Tax Season in Oradell with Personal Tax Returns

For many individuals and families, the annual obligation of filing personal tax returns in Oradell can be a source of significant anxiety and confusion. At Rosen CPA LLC, we strive to transform this often-dreaded process into an opportunity for financial clarity and strategic growth. We understand that your tax return is not just a form to be filed with the IRS; it is a financial scorecard that reflects your hard work, investments, and life changes over the past year. Whether you are a high-net-worth individual with a complex portfolio or a family ensuring you maximize your deductions, our family-style firm offers the personalized attention you deserve.

We believe in building long-term relationships based on transparency and trust. We do not offer gimmicks or quick fixes; instead, we provide the truth and the technical guidance necessary to keep you compliant and financially healthy. Residents who trust Rosen CPA LLC for their personal tax returns in Oradell gain a partner dedicated to accuracy, accountability, and preserving their wealth. We take the time to listen to your objectives, acting as a second set of eyes on your financial life to ensure no opportunity is missed. When you need an expert accounting company serving Oradell, we are here to provide a seamless client experience that goes beyond simple data entry to deliver true peace of mind.

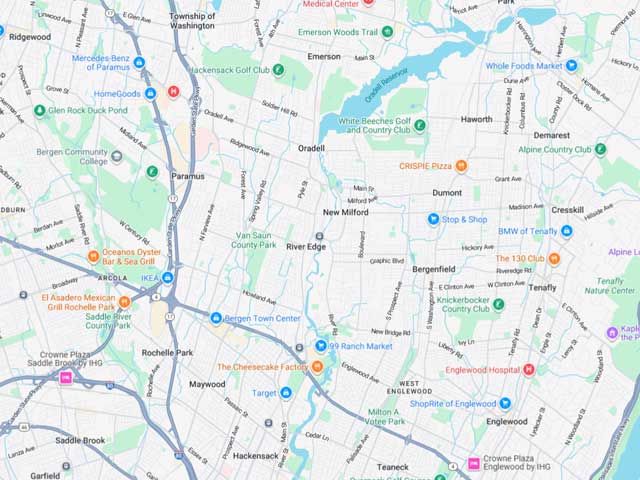

Our expertise extends to navigating the complexities of modern employment and investment landscapes. We assist remote workers, business owners, and investors in understanding how their specific situations impact their tax liabilities. From handling multi-state filings to advising on the tax implications of divorce or moving states, we are committed to helping you make better decisions. We are a firm that tells it like it is, offering clear billing structures with no surprises, so you can focus on what matters most to you while we handle the numbers in Oradell.

Individual Income Tax Filing That Ensures Your Return is Accurate & On Time

The preparation of personal tax returns has become increasingly complicated with the introduction of new tax laws and regulations. At Rosen CPA LLC, we stay ahead of these changes to ensure that your filings are not only compliant but also optimized for tax efficiency. We handle the preparation of federal Form 1040 and all associated state returns, meticulously reviewing every schedule to ensure accuracy. This includes Schedule A for itemized deductions, where we analyze mortgage interest, charitable contributions, and medical expenses to determine if itemizing is more beneficial than the standard deduction.

Furthermore, we understand that life doesn't always go according to plan. If you are behind on your filings, we offer judgment-free assistance with unfiled tax returns. We can help you catch up, file extensions when necessary, and calculate safe-harbor estimated tax payments to avoid underpayment penalties in the future. If you are facing a tax controversy, our experience with IRS audit representation means we can defend your return and resolve issues efficiently.

Call Us

Leave a Review

Strategic Planning For Complex Financial Portfolios

For many of our clients, a personal tax return involves much more than just W-2 income. We specialize in working with investors, business owners, and professionals who have complex income streams that require sophisticated reporting. If you hold stock options, we provide in-depth planning for Restricted Stock Units (RSU) and Non-Qualified Stock Options (NQSO), helping you understand the timing of income recognition and how to manage the resulting tax bill. We also assist with the reporting of privately held investments and foreign financial interests, including the preparation of Form 8938 and FBAR (Foreign Bank Account Reports).

Our accounting team is also well-versed in the specific needs of business owners who file their business activity on their personal returns. We expertly prepare Schedule C for sole proprietorships and Schedule E for rental real estate owners. For those with rental properties, we ensure that you are taking advantage of all available depreciation deductions and properly categorizing repairs versus improvements. We also guide business owners through the nuances of the Section 199A Qualified Business Income deduction, which can offer substantial savings for eligible taxpayers.

In addition to annual compliance, we look at the long-term picture of your wealth. This often involves coordination with fiduciary accounting if you are the beneficiary or trustee of a trust. We ensure that the income reported on Schedule K-1s from trusts, estates, or investment partnerships is correctly integrated into your personal return. We also provide strategic tax planning for wealth transfer between spouses and subsequent generations, helping you preserve your family legacy.

Frequently Asked Personal Tax Returns Questions

Online tax software can be a useful tool for very simple tax situations, but it often falls short when finances become more complex. While software may appear cost-effective upfront, it is designed to process the information you enter rather than evaluate whether that information is complete or being applied in the most advantageous way. A CPA brings judgment, experience, and critical thinking to the process, which can uncover opportunities and risks that software simply cannot identify.

Hiring a CPA also reduces the risk of errors that can trigger audits, notices, or penalties. When tax laws change, software updates may not fully explain how those changes apply to your specific situation. A CPA stays informed on evolving regulations and ensures your return reflects current law. Beyond filing the return, a CPA provides guidance throughout the year, helping you plan rather than reacting after the fact. For many taxpayers, the value of accuracy, insight, and peace of mind far outweighs the initial cost.

Moving or working remotely can significantly complicate your tax situation, particularly when income is earned across state lines. If you live in one state but work for an employer based in another, or if you relocate during the tax year, you may be required to file tax returns in multiple states. Each state has its own rules governing residency, income sourcing, and filing thresholds, which makes compliance more challenging than it may appear on the surface.

Remote work can also affect withholding, estimated tax payments, and employer reporting obligations. A CPA helps evaluate your specific circumstances to determine which states require filings and how income should be allocated. By addressing these issues proactively, a CPA can help minimize surprises, ensure compliance, and provide clarity in an increasingly complex remote work environment.

Our Recent Articles

-

Tax Tips for Remote Workers

The rise of the "work-from-home" era has fundamentally changed the landscape of individual tax return preparation. For many residents in Oradell, what began as a temporary measure has evolved into a permanent lifestyle. However, while remote work offers flexibility and convenience, it also introduces significant complexities […]