Tax Tips for Remote Workers

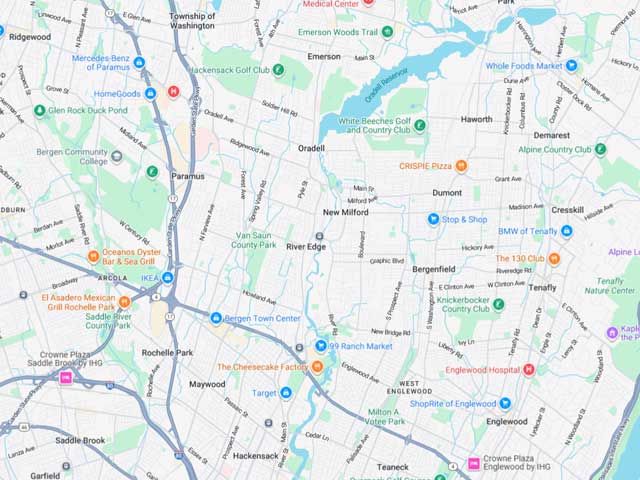

The rise of the "work-from-home" era has fundamentally changed the landscape of individual tax return preparation. For many residents in Oradell, what began as a temporary measure has evolved into a permanent lifestyle. However, while remote work offers flexibility and convenience, it also introduces significant complexities regarding personal tax returns. If you live in New Jersey but your employer is based in New York, Connecticut, or another state, you are likely a part of the growing group of multi-state filers who must navigate overlapping tax laws and residency requirements.

Understanding how your physical location impacts your tax liability is essential for maintaining tax compliance. Without proactive planning, remote workers can find themselves facing unexpected bills or even residency/domicile audits. To ensure you are leveraging the tax code to your advantage, it is important to treat your remote setup with the same professional scrutiny as a brick-and-mortar business operation. Effective accounting in Oradell is the foundation for avoiding these pitfalls and ensuring that your financial strategy accounts for the "new normal" of the professional world.

For additional assistance with personal tax returns in Oradell from an expert you can count on, call us today at 201-971-4110.

Navigating the Challenges of Multi-State Taxation

When you work remotely across state lines, the most immediate concern is determining which state has the "first right" to tax your income. This is often dictated by the "convenience of the employer" rule, a policy used by states like New York and Connecticut to tax employees based on where their office is located, regardless of where the employee actually performs the work. This can be a shock to workers in Oradell who assume that working from their home office means they only owe taxes to New Jersey.

Deductions and Credits for the Home Office

One of the most common questions for remote employees is whether they can claim the home office deduction. Under current federal law, the home office deduction is generally reserved for self-employed individuals and those operating as proprietorships or LLCs. If you are a W-2 employee, you typically cannot deduct home office expenses on your federal return, though some states offer specific local credits or deductions that are worth exploring.

For those who are self-employed or run a small business tax help consultancy from home, the rules are more favorable. You can deduct a portion of your housing expenses, such as utilities, insurance, and mortgage interest, based on the square footage of your dedicated workspace. Additionally, you may be able to utilize Section 179 depreciation for office equipment, computers, and furniture purchased to facilitate your remote work. Keeping meticulous accounting records is the only way to ensure these deductions are defensible in the event of an IRS audit.

Residency and Domicile Audit Risks

If you are a taxpayer planning on moving states or shifting to a permanent remote role, consulting and planning with a cpa is vital. State tax authorities have become increasingly aggressive in pursuing residency/domicile audits, especially for high earners who move to lower-tax states while maintaining ties to their original home. Establishing a clear "domicile" involves more than just a change of address; it requires a demonstrated intent to make the new location your permanent home.

The government may look at "lifestyle factors" such as where you are registered to vote, where your vehicles are insured, and even where your primary medical professionals are located. For business owners, this is even more complex, as the physical location of the owner can impact NJ BAIT (business alternative income tax) filings and PTET planning. A robust financial planning strategy must account for these nuances to prevent the state from claiming you never truly left, resulting in years of back taxes and interest.

Strategic Tax Planning for Mobile Professionals

Beyond the immediate filing requirements, remote workers should engage in proactive tax planning to maximize their long-term wealth. This includes analyzing the tax implications of stock option planning, such as nqso or rsu planning, which can be taxed differently depending on where you lived when the options were granted versus when they vested. If you work for a company with a global presence, you may also need to consider foreign tax credits or file an FBAR (foreign bank account report) if you hold assets in international accounts.

At Rosen CPA LLC, we specialize in tax advice for remote workers and understand the unique dynamics of multi-state tax service. With offices in Oradell, NJ, and Greenwich, Connecticut, we are uniquely positioned to help taxpayers who navigate the "tri-state" tax maze. We can help you manage your tax projections, prepare for tax extensions, and ensure that your overall strategy accounts for the specific rules of each jurisdiction. By taking the time to listen to your objectives, we provide the guidance needed to protect your interests and prevent costly filing errors.

Leveraging Business Structures for Remote Work

For many high-level professionals, transitioning from a W-2 employee to a 1099 contractor or a business owner can provide significant tax advantages. By forming an LLC or an S corporation, a remote worker can gain access to a wider range of deductions and more flexible tax management options. For example, a business owner can contribute to a SEP-IRA or a solo 401k, which allows for much higher retirement contributions than a standard employee plan.

This transition also opens the door for business tax advisory service benefits, such as section 199a planning and optimized fiduciary return preparation for those with complex estate or trust interests. However, these benefits come with increased administrative responsibilities, including the need for financial statement preparation for income tax returns and staying on top of NJ sales tax obligations if you provide taxable services. Having an experienced family-style business accountant ensures that as your career evolves into a business, your tax strategy evolves with it.