Achieve Financial Success in Oradell with Professional Business Accounting

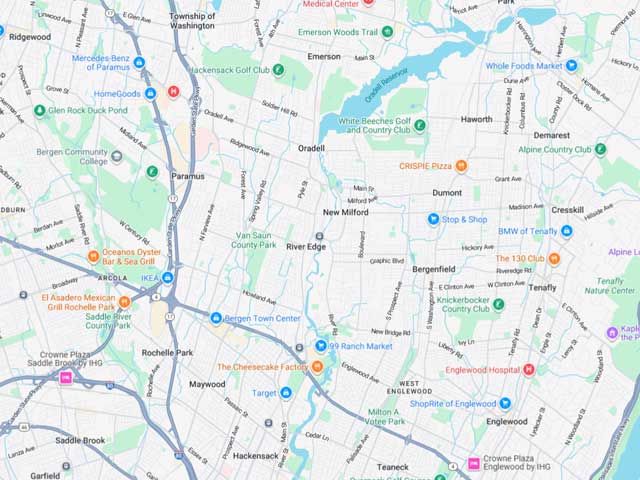

Business owners in Oradell face constant pressure to manage cash flow, compliance, and long-term planning while staying focused on running their companies. Our approach to business accounting is designed to provide clarity, structure, and dependable financial insight from day one. Our firm delivers business accounting in Oradell with a proactive, relationship-driven approach that supports confident decision-making and sustainable growth.

At Rosen CPA LLC, we work closely with business owners to ensure their financial foundation supports both day-to-day operations and long-term objectives. Our services are built for closely held businesses, family enterprises, and growing companies that need more than basic data entry or year-end reporting. We believe business accounting should serve as a strategic resource that informs decisions, identifies risks early, and supports sustainable growth.

We proudly serve companies seeking professional accounting services in Oradell and the surrounding areas, offering responsive guidance and a seamless client experience. Our team takes the time to understand your business structure, industry, and goals so we can tailor solutions that align with how you actually operate.

Corporate Financial Management Built for Stability & Scale

Strong financial management is essential to maintaining stability while preparing for growth. Without reliable financial data, business owners are left making decisions based on assumptions rather than facts. Our role is to provide structure and insight so your financial information becomes a reliable decision-making tool.

We assist with financial statement preparation, review of bookkeeping systems, and oversight of key transactions to ensure accuracy and consistency. For businesses with internal accounting staff or external bookkeepers, we act as a trusted second set of eyes, reviewing work, addressing inconsistencies, and advising on best practices. This oversight helps reduce errors, strengthen internal controls, and ensure financial records align with compliance and planning goals.

As businesses grow, financial complexity increases. Entity expansion, additional owners, changing compensation structures, and new revenue streams all introduce additional considerations. Our support scales with your business, ensuring systems and reporting evolve alongside growth rather than lag behind it.

Strategic Support Beyond The Numbers

Effective financial management goes beyond reconciliations and reports. We help business owners understand how accounting and tax planning work together to support cash flow management, operational efficiency, and long-term planning.

Our business accounting services integrate seamlessly with business tax preparation to ensure year-end filings reflect accurate financial data and identify planning opportunities throughout the year. Instead of scrambling at filing time, our clients benefit from proactive guidance that supports smarter decisions well before deadlines arrive.

For businesses with fiduciary responsibilities or ownership interests involving trusts and estates, we also coordinate closely with fiduciary accounting needs. This ensures consistent reporting, proper documentation, and compliance across related entities, reducing risk and improving transparency for stakeholders.

This integrated approach allows us to identify potential issues early, address them proactively, and help clients plan rather than react. By aligning financial reporting with tax strategy and long-term objectives, we help business owners remain prepared for growth, transitions, and unexpected challenges.

Call Us

Leave a Review

A Relationship-Focused Approach For Business Owners

We believe successful business accounting relationships are built on trust, communication, and accessibility. Our clients value knowing they have a dedicated team that listens carefully, responds promptly, and provides straightforward guidance without unnecessary complexity or jargon.

Rosen CPA LLC supports a wide range of industries, including medical practices, contractors, manufacturers, fitness centers, restaurants, retailers, and professional service firms. Many of our clients operate multiple entities or involve multiple family members holding various ownership interests. These structures require careful coordination, long-term planning, and an understanding of both business and personal implications.

Our role extends beyond compliance. We help business owners think strategically about cash flow, expansion, succession, and risk management. Whether you are evaluating a major purchase, adding a partner, or planning for long-term continuity, we provide insight grounded in experience and technical knowledge.

If you're looking for dependable guidance and long-term business accounting support, Rosen CPA LLC is here to help your business move forward with clarity and confidence.

Frequently Asked Business Accounting Questions

While internal staff or accounting software can effectively manage day-to-day recordkeeping, professional accounting services add a critical layer of oversight and expertise that internal teams often cannot provide on their own. A professional firm brings a broader perspective informed by experience across industries, business structures, and regulatory environments. This allows potential issues to be identified early, before they turn into costly problems.

Professional oversight also helps ensure consistency across reporting periods, which is essential for accurate financial analysis and reliable tax reporting. Changes in accounting rules, tax regulations, and compliance requirements can be difficult to track internally, especially as a business grows. Working with a professional firm helps ensure that financial records align with current standards and that decisions are made with both short-term and long-term implications in mind. Beyond compliance, professional accounting support provides strategic insight that helps business owners understand their numbers and use them to make better operational and financial decisions.

Yes. We regularly work alongside internal bookkeepers, staff accountants, and external financial advisors. Our goal is not to replace your existing team, but to strengthen it. By serving as a review and advisory resource, we help ensure that work is completed accurately, consistently, and in line with best practices.

This collaborative approach allows internal teams to focus on day-to-day operations while we provide guidance on more complex accounting issues, transaction treatment, and overall financial strategy. We also help establish clear processes and accountability, reducing the risk of miscommunication or duplicated efforts. Clients often find that this partnership improves confidence in their financial reporting while preserving the structure and relationships they already have in place.

Financial reporting frequency is tailored to your business's size, structure, and operational needs. Some businesses benefit from monthly reporting and regular review meetings that provide timely insight into performance, cash flow, and emerging trends. Others prefer quarterly reporting that focuses on higher-level analysis and planning.

We work with clients to determine the right balance between insight and efficiency. The goal is to deliver information that is timely, relevant, and actionable without creating unnecessary administrative burden. As a business evolves, reporting needs may change, and we adjust accordingly to ensure financial information continues to support informed decision-making.

No. Our services are designed to support small and mid-sized businesses at all stages of growth. Many of our clients are emerging companies that need guidance as they establish sound accounting practices, while others are more established businesses with increasingly complex financial structures.

Because our services are scalable, clients can engage us for the level of support that makes sense for their current needs and expand that support as their business grows. This flexibility allows businesses to access professional expertise without taking on unnecessary cost or complexity.

Our Recent Articles

-

Tax Tips for Remote Workers

The rise of the "work-from-home" era has fundamentally changed the landscape of individual tax return preparation. For many residents in Oradell, what began as a temporary measure has evolved into a permanent lifestyle. However, while remote work offers flexibility and convenience, it also introduces significant complexities […]

-

The Ultimate Year-End Tax Prep Checklist

Tax season often feels like a race against the clock, but proactive preparation can turn a stressful deadline into a strategic opportunity for your company. Whether you are managing Partnerships, S-Corps, or C-Corps, the key to a successful filing lies in the quality of your documentation. […]