Experienced Accounting & Tax Services in Bergen County, NJ

Rosen CPA LLC delivers experienced accounting and tax services tailored to individuals, families, and business owners throughout Oradell and the surrounding area. Our firm combines technical precision with practical, real-world guidance to help clients remain compliant, plan ahead, and make informed financial decisions with confidence. We believe strong accounting should provide clarity, not confusion, and should serve as a foundation for smarter planning and sustainable growth.

Our services support a wide range of needs, from personal tax returns to complex business, trust, and fiduciary matters. We work with business owners, family enterprises, and closely held entities that require thoughtful tax planning and reliable accounting oversight. Each engagement is approached with care, attention to detail, and an understanding of how financial decisions today can affect long-term outcomes.

What sets Rosen CPA LLC apart is our relationship-driven approach. We take the time to listen and understand each client's objectives before offering guidance. Whether you are navigating business growth, managing multiple entities, planning for future transitions, or simply seeking clarity around your tax position, our advice is tailored to your goals rather than delivered from a one-size-fits-all perspective.

When appropriate, we collaborate closely with our clients' existing legal, financial, and internal accounting teams. We often serve as a trusted second set of eyes for bookkeepers and staff accountants, helping review key transactions, strengthen internal controls, and ensure accounting systems are aligned with best practices. This collaborative approach helps reduce risk, improve accuracy, and support better decision-making.

At Rosen CPA LLC, our work goes beyond forms, filings, and deadlines. We provide proactive insight, clear communication, and dependable support when questions or challenges arise. Clients rely on us not just for compliance, but for steady guidance that helps them move forward with confidence and long-term success in mind.

Read More About UsComprehensive Tax & Accounting Services

Tax Guidance for Business Owners & Families

Rosen CPA LLC provides trusted tax guidance for business owners and families navigating complex financial and tax decisions. We help clients understand how accounting and tax planning can be used strategically to manage cash flow, minimize risk, and support long-term personal and business goals.

Whether you operate a closely held business, manage multiple entities, or oversee family investments and trusts, our accounting team delivers proactive advice rooted in experience. We focus on planning, compliance, and collaboration to help protect wealth today while positioning clients for the future.

View Our Individual Services View Our Business ServicesOur Testimonials

Coming Soon!

Who We Serve

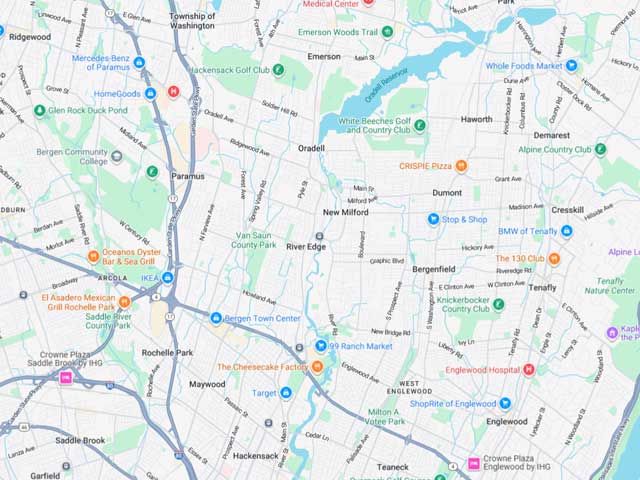

We serve individuals, families, and business owners seeking reliable accounting guidance and proactive tax support all across the greater Oradell region. Our clients range from entrepreneurs and closely held businesses to investors, trusts, and family enterprises with complex financial needs.

- Oradell, NJ

- Paramus, NJ

- Hackensack, NJ

- Ridgewood, NJ

- River Edge, NJ

- Englewood, NJ

- New Milford, NJ

- Haworth, NJ

- Tenafly, NJ

- Dumont, NJ

- Township of Washington, NJ

- Mahwah, NJ

- Ramsey, NJ

- Allendale, NJ

- Wyckoff, NJ

Frequently Asked Questions

Getting started with your personal tax returns is easier when you gather documents that provide a complete picture of your income, deductions, and financial activity for the year. This typically includes income statements such as W-2s, 1099s, K-1s, and records of investment income, along with prior year tax returns for reference. You should also collect documentation related to deductions and credits, including mortgage interest statements, real estate tax bills, charitable contributions, medical expenses, retirement contributions, and education-related costs.

If you own a business or rental property, profit and loss statements, depreciation schedules, and expense records are also important. Providing complete and organized information allows your Accountant to prepare accurate returns, identify planning opportunities, and reduce the risk of errors or missed tax benefits.

Business tax services involve a broader and more strategic scope than personal tax services because they extend beyond reporting income to managing ongoing compliance, planning, and advisory needs. In addition to preparing business tax returns, these services often include entity selection guidance, estimated tax planning, payroll and sales tax considerations, depreciation strategies, and coordination with bookkeeping and financial statements.

Business tax services also focus heavily on proactive planning to manage cash flow, support growth, and minimize future tax exposure. Personal tax services, while still complex, are generally centered on individual income, deductions, credits, and compliance, whereas business services require continuous monitoring and strategic decision-making throughout the year.

If you receive an IRS audit notice, the most important step is not to panic and not to respond without professional guidance. Audit notices can range from simple document requests to more comprehensive examinations, and responding incorrectly or incompletely can create unnecessary complications. You should carefully review the notice, note any deadlines, and gather the documents referenced, but allow an experienced accounting pro like Rosen CPA LLC to handle communications with the Internal Revenue Service on your behalf.

Proper representation ensures responses are accurate, timely, and limited to what is required, while protecting your rights throughout the process. With the right support, many audits can be resolved efficiently and with minimal disruption.

Yes, identifying industry-specific deductions is a critical part of effective tax planning and one of the key advantages of working with an experienced accountant. Different industries have unique expense structures, regulatory requirements, and tax opportunities that can significantly impact taxable income.

By understanding how your business operates, we can identify allowable deductions related to equipment, inventory, professional fees, depreciation, compensation, and industry-specific credits or incentives. This tailored approach helps ensure your business is not only compliant but also positioned to take advantage of deductions that are often overlooked, resulting in more efficient tax outcomes and better long-term planning.

Tax Planning Insights & Resources

-

Tax Tips for Remote Workers

The rise of the "work-from-home" era has fundamentally changed the landscape of individual tax return preparation. For many residents in Oradell, what began as a temporary measure has evolved into a permanent lifestyle. However, while remote work offers flexibility and convenience, it also introduces significant complexities […]

-

The Ultimate Year-End Tax Prep Checklist

Tax season often feels like a race against the clock, but proactive preparation can turn a stressful deadline into a strategic opportunity for your company. Whether you are managing Partnerships, S-Corps, or C-Corps, the key to a successful filing lies in the quality of your documentation. […]