Get the Most On Your Return with Help from Our Business Tax Preparation Experts in Oradell

Rosen CPA LLC's approach to business tax preparation in Oradell focuses on accuracy, planning, and long-term clarity for business owners who want dependable guidance.

Business owners often face constant pressure to meet deadlines, stay compliant, and adapt to changing tax laws, which makes business tax preparation in Oradell a critical part of running a successful company. At Rosen CPA LLC, we provide structured and reliable support so filings are accurate, timely, and aligned with your broader financial picture.

We work with closely held businesses, family enterprises, and growing companies that need more than transactional filing services. Our team takes the time to understand how your business operates, how revenue is generated, and how ownership is structured. This allows us to prepare returns that reflect the full scope of your activity while identifying opportunities to manage risk and improve outcomes.

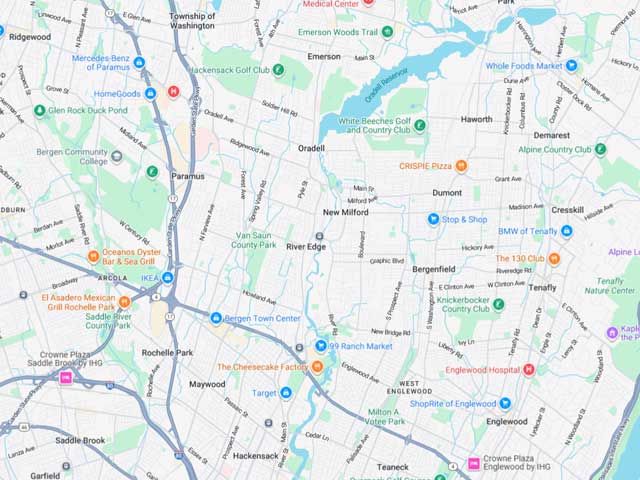

Clients looking for full-service accounting in Oradell appreciate our commitment to clear communication and proactive support. We believe effective tax preparation starts with strong organization and continues throughout the year, not just at filing time.

Simplifying Corporate Tax Filing for Today's Growing Companies

Corporate tax filing can quickly become complex as businesses expand, add owners, or operate across multiple states. Entity type, revenue streams, and compensation structures all play a role in how returns should be prepared. Our firm supports corporations, partnerships, and pass-through entities with careful attention to detail and compliance requirements.

We prepare returns for S corporations, C corporations, partnerships, and LLCs by reviewing financial statements, reconciling records, and addressing reporting requirements specific to each entity type. Our process helps ensure income, deductions, depreciation, and credits are properly reported and supported. This reduces the likelihood of errors while creating consistency from year to year.

Our tax preparation work is closely coordinated with business accounting services, so financial data and tax filings remain aligned. When accounting records are reviewed and maintained throughout the year, the filing process becomes more efficient and less stressful for business owners.

Proactive Planning That Supports Better Outcomes

Effective tax preparation should support planning, not just compliance. We help business owners understand how current decisions affect future filings, cash flow, and growth opportunities. This includes guidance on estimated tax payments, timing of income and expenses, and planning for capital investments or ownership changes.

Our business tax preparation team regularly works with businesses that face added complexity due to multi-state operations, remote employees, or industry-specific regulations. By addressing these issues proactively, we help clients avoid surprises and reduce exposure to penalties or unnecessary tax liabilities.

When issues arise with taxing authorities, we coordinate closely with IRS audit representation to ensure matters are handled efficiently and professionally. Having experienced support in place provides reassurance and protects business owners from making costly mistakes during correspondence or examinations.

Supporting Businesses Across Industries And Structures

We serve a broad range of industries, including medical practices, contractors, manufacturers, restaurants, retailers, fitness centers, and professional service firms. Many of our clients operate multiple entities or involve family members with varying ownership interests. These structures require thoughtful coordination and consistent reporting across all related filings.

Our experience with complex ownership arrangements allows us to help businesses maintain compliance while supporting long-term planning goals. We understand that tax preparation does not exist in isolation and must align with broader financial strategies and operational realities.

By maintaining open communication and ongoing engagement, we help business owners stay informed and prepared throughout the year with our business tax preparation. This approach allows us to provide meaningful guidance rather than reactive advice during filing season.

Call Us

Leave a Review

A Clear And Collaborative Client Experience

We believe business owners deserve transparency and accessibility from their professional advisors. Our clients know what to expect because we outline processes, timelines, and responsibilities clearly from the start. We also offer online and in-person meetings to accommodate busy schedules and evolving needs.

For clients with internal accounting staff or external bookkeepers, we collaborate closely to ensure consistency and accuracy. Acting as a checkpoint rather than a replacement, we help strengthen systems and reduce the risk of errors that can impact filings. This collaborative approach allows business owners to focus on running their companies while knowing their tax obligations are being handled with care and precision.

If you are looking for reliable business tax preparation, Rosen CPA LLC is ready to help your business approach tax preparation with confidence and clarity.

Frequently Asked Business Tax Preparation Questions

Business tax rules are complex, highly detailed, and subject to frequent change. Professional business tax preparation helps ensure that returns are accurate, complete, and fully compliant with current tax laws and reporting requirements. Beyond meeting filing obligations, a professional approach helps identify deductions, credits, and planning opportunities that are often overlooked when using basic software or handling taxes internally.

Professional preparation also reduces the risk of errors that can lead to notices, penalties, or audits. By understanding how your business operates and how financial decisions affect tax outcomes, a professional firm can align tax filings with broader planning strategies. This creates a more informed, proactive approach to managing tax exposure rather than reacting to issues after the fact.

Yes. We regularly work with businesses that operate through multiple entities, have related-party transactions, or include layered ownership structures. These arrangements require careful coordination to ensure income, expenses, and transactions are reported consistently and accurately across all filings.

Proper handling of multi-entity or multi-owner businesses is essential for compliance and effective planning. We help ensure that entity relationships are clearly documented, reporting is aligned across federal and state returns, and ownership interests are reflected correctly. This coordinated approach helps reduce risk, improve clarity, and support more strategic decision-making.

Starting the tax preparation process early provides valuable time to review financial records, address inconsistencies, and correct issues before deadlines approach. Early preparation reduces last-minute pressure and helps improve the accuracy and completeness of your filings.

An early start also creates opportunities for proactive planning. By reviewing results ahead of time, business owners can better manage cash flow, plan for estimated tax payments, and evaluate strategies to reduce tax liability. This forward-looking approach turns tax preparation into a planning tool rather than a reactive task.

No. We work with businesses at all stages of development, from newer companies to well-established enterprises. Many early-stage businesses benefit from professional guidance as they establish accounting systems, choose entity structures, and plan for growth.

Because our services are scalable, we can adjust the level of support as your business evolves. Whether you need foundational guidance or more advanced planning and compliance support, our approach is designed to grow alongside your business and adapt to changing needs.

Our Recent Articles

-

The Ultimate Year-End Tax Prep Checklist

Tax season often feels like a race against the clock, but proactive preparation can turn a stressful deadline into a strategic opportunity for your company. Whether you are managing Partnerships, S-Corps, or C-Corps, the key to a successful filing lies in the quality of your documentation. […]