Trust Rosen CPA LLC for Exceptional Tax Services in Oradell

Finding a partner who can navigate the constantly changing landscape of tax services in Oradell is essential for securing your financial future. At Rosen CPA LLC, we provide more than just annual filing; we offer a relationship grounded in trust, transparency, and technical excellence. We understand that whether you are managing a growing business, a complex estate, or a multi-faceted personal portfolio, the stakes are high.

Our family-style firm is dedicated to serving the local community with the same level of care and attention we would provide to our own family members. We take the time to listen to your objectives, acting as a second set of eyes on your financial life to ensure that every decision supports your long-term goals.

We operate with a philosophy of absolute truth—no gimmicks, no scams, just the clear, honest guidance you need to get back on the right track or stay ahead of the curve. Residents and business owners rely on us because our professional tax services in Oradell are built on a foundation of accuracy, accountability, and proactive communication. We understand that accounting can be intimidating, which is why we strive to make the process as seamless as possible. When you choose our reliable accounting firm in Oradell, you are choosing a firm that collaborates with your existing team of professionals to create a cohesive financial strategy.

What we do extends far beyond simple form-filling. We are deeply experienced in handling complex scenarios for medical offices, contractors, manufacturers, and retailers. We also specialize in assisting families with multiple entities and related parties, ensuring that the interplay between business and personal finances is handled correctly.

Whether you are looking to resolve unfiled tax returns, negotiate an installment plan, or simply ensure your current filings are optimized, we are here to help. We believe that the reason clients stick with us is that when they need us most—whether during a difficult audit or a major life transition—we are there to provide the support and technical knowledge necessary to weather the storm.

Advanced Strategies For Wealth Preservation And Compliance

In today's regulatory environment, effective tax management requires a forward-thinking approach that anticipates changes in the law. At Rosen CPA LLC, we specialize in advanced planning strategies that go beyond the basics. For our business clients, we provide in-depth guidance on the New Jersey Business Alternative Income Tax (NJ BAIT) and Pass-Through Entity Tax (PTET). These elections can be powerful tools for S-Corps and Partnerships to navigate the federal SALT Cap rules, potentially saving significant amounts of money. We also advise on "One Big Beautiful Bill" planning and Section 199A to ensure that you are maximizing your qualified business income deductions.

For individuals and families, our tax services cover a broad spectrum of needs, including the preparation of fiduciary returns for trusts and estates (Form 1041). We understand the unique dynamics of advising a family involved with multiple businesses and how strategic decisions can help preserve a family legacy. We assist with Section 754 elections to adjust the basis of partnership property, as well as complex stock option planning for those with Restricted Stock Units (RSU) or Non-Qualified Stock Options (NQSO). If you have international interests, we handle foreign tax credits (Form 1116), FBAR filings, and Form 8938 to ensure you remain compliant with global reporting standards.

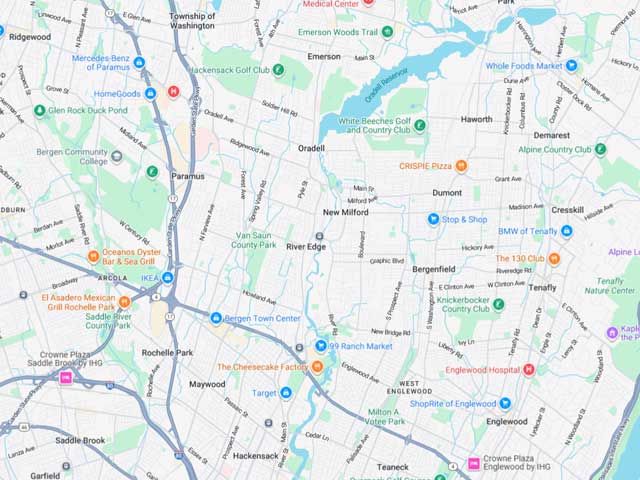

We also recognize the growing complexity of the modern workforce. With more people working remotely or moving between states, residency and domicile audits have become a significant area of concern. We provide expert advice for remote workers and multi-state filers, analyzing your situation to prevent double taxation and defend your residency status.

Our team stays current on all local Oradell and state regulations, as well as federal changes, to provide you with the most up-to-date advice possible. Whether it involves Section 179 depreciation for your business assets or strategic planning for wealth transfer between spouses, our goal is to help you make better decisions for yourself and your business.

Frequently Asked Tax Services Questions

Many business owners think of taxes as a once-a-year obligation tied to filing deadlines, but true financial efficiency comes from treating tax planning as an ongoing process rather than a single annual task. Year-round professional tax planning focuses on understanding your business's financial activity as it unfolds and using that information to make informed, strategic decisions well before returns are due.

By looking at your business's financial health holistically, professional tax planning turns taxes into a strategic tool rather than a reactive burden. It helps business owners anticipate obligations, manage cash flow more effectively, and align financial decisions with broader business objectives. The result is greater control, improved clarity, and a more confident approach to both planning and compliance.

Receiving a notice from the IRS or a state tax agency can be alarming, but it is important not to panic. The first step is to read the notice carefully to understand what is being requested or disputed. Often, these notices are computer-generated and may simply be requesting verification of a specific number or pointing out a math error. However, they can also signal the start of an audit or a demand for payment. The most critical mistake you can make is to ignore the notice, as this can lead to escalating penalties and collection actions.

Our Recent Articles

-

Tax Tips for Remote Workers

The rise of the "work-from-home" era has fundamentally changed the landscape of individual tax return preparation. For many residents in Oradell, what began as a temporary measure has evolved into a permanent lifestyle. However, while remote work offers flexibility and convenience, it also introduces significant complexities […]

-

The Ultimate Year-End Tax Prep Checklist

Tax season often feels like a race against the clock, but proactive preparation can turn a stressful deadline into a strategic opportunity for your company. Whether you are managing Partnerships, S-Corps, or C-Corps, the key to a successful filing lies in the quality of your documentation. […]