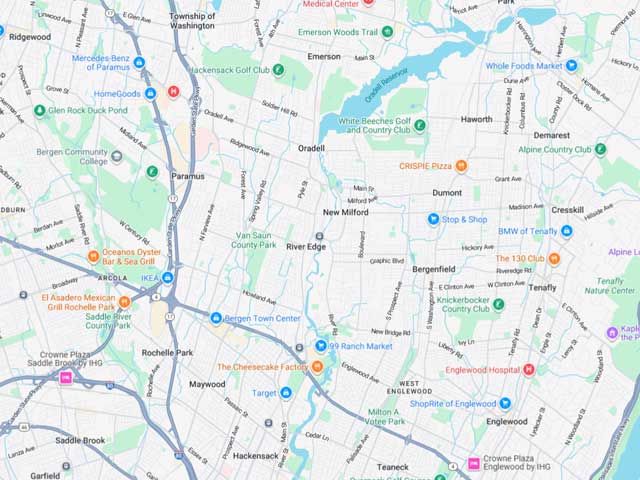

IRS Audit Services for Oradell That Protect Your Business & Peace of Mind

Receiving an official notice regarding an IRS audit in Oradell is one of the most stressful events a taxpayer or business owner can experience, often triggering immediate anxiety and uncertainty.

At Rosen CPA LLC, we specialize in navigating the complexities of an IRS audit, acting as a shield between you and the tax authorities to ensure your case is handled with the utmost professionalism. Whether you are facing a correspondence audit, an office examination, or a comprehensive field audit, you do not have to face the government alone. Our firm provides a steady hand and a clear head, helping you organize your records, formulate a defense strategy, and respond to inquiries with accuracy.

We pride ourselves on being a family-style firm that prioritizes the truth above all else. When dealing with tax authorities, there is no room for gimmicks or evasion; you need a partner who will give you an honest assessment of your situation and a clear path forward. Residents and business owners seeking support for an IRS audit in Oradell trust our firm to provide the aggressive representation and technical expertise necessary to achieve the best possible outcome. We understand that audits often arise from simple discrepancies or misunderstandings, but they can also signal deeper compliance issues that require strategic resolution. By hiring Oradell's trusted accounting provider, you ensure that your financial narrative is presented correctly, minimizing the risk of excessive penalties and interest.

We can handle a wide range of tax controversies, from simple mathematical errors to complex residency and domicile audits for individuals moving between states. We act as your advocate, communicating directly with the agents so you can focus on your daily life and business operations in Oradell. We are here to help you get back into the system and back on the right track, offering judgment-free guidance for those with unfiled returns or outstanding liabilities. Find out why clients rely on us to resolve their most critical financial challenges with integrity and transparency.

Precise Federal Tax Examinations

When the Internal Revenue Service selects a return for examination, the burden of proof generally falls on the taxpayer to substantiate the income, deductions, and credits reported. This process requires a meticulous review of your financial history and a deep understanding of tax law to prevent a manageable inquiry from spiraling into a significant liability. At Rosen CPA LLC, we approach every examination with a focus on organization and compliance. We review the specific items being questioned—whether they relate to business tax preparation, charitable contributions, or employee expenses—and gather the necessary documentation to support your position.

Our goal during a federal tax examination is to limit the scope of the audit and bring it to a prompt conclusion. We understand the triggers that often lead to scrutiny, such as disproportionate deductions on a Schedule C, large non-cash charitable contributions, or complex rental real estate losses. By proactively organizing your records and presenting them clearly to the auditor, we demonstrate that your filings were made in good faith. We also advise on the nuances of tax law that an auditor might overlook, ensuring that you are treated fairly under the Taxpayer Bill of Rights.

For businesses, an examination can be particularly disruptive, potentially involving interviews with employees or tours of your facility. We act as a buffer, managing the flow of information and ensuring that the auditor's requests are reasonable and within the legal scope of the examination.

Call Us

Leave a Review

Resolving Unfiled Returns And Tax Liabilities

Many of the clients we assist are not just facing an audit of a filed return, but are dealing with the stress of unfiled tax returns or significant back taxes. Life events, business struggles, or simple procrastination can lead to a backlog of unfiled paperwork, but ignoring the problem will only lead to escalating penalties and aggressive collection actions. We provide a safe, non-judgmental environment to help you voluntarily disclose your financial situation and become compliant. Our IRS audit team specializes in constructing prior year returns, often reconstructing income and expenses from bank records when original documents are missing.

Once the returns are filed and the liability is established, we work with you to manage the debt. We understand that you may not be able to pay the full amount immediately, and we are skilled in negotiating payment options that fit your budget. We assist with setting up Installment Agreements that allow you to pay off the debt over time, and in certain cases, we can help submit an Offer in Compromise (OIC). An OIC allows qualifying taxpayers to settle their tax debt for less than the full amount owed if they can prove that paying the full amount would cause financial hardship.

In addition to federal issues, we are deeply experienced in state-level compliance, particularly regarding residency and domicile audits. If you have moved out of a high-tax state or are a remote worker with multi-state income, you may face aggressive inquiries from state tax departments seeking to claw back revenue. We defend your position by analyzing the "teddy bear" factors—where your family lives, where your business is located, and where you keep your most personal assets—to prove your true legal residence. Whether it involves personal tax returns or complex business filings, our objective is to minimize your exposure and resolve the issue permanently.

Frequently Asked IRS Audit Questions

Technically, you have the right to represent yourself during an IRS audit, but doing so is often a risky financial decision. Tax law is incredibly complex, and IRS auditors are trained to identify discrepancies and extract information that can lead to higher tax bills. When you represent yourself, you risk inadvertently providing more information than is required, which can expand the scope of the audit into other years or other areas of your finances. You might also miss out on legitimate defenses or appeal rights simply because you are not familiar with the procedural rules.

If you have unfiled tax returns, the most important step is to take action before the IRS contacts you. The IRS has a voluntary disclosure practice that generally provides a pathway to get back into the system with reduced risk of criminal prosecution, provided you come forward before an investigation starts. At Rosen CPA LLC, we specialize in helping "non-filers" get back on track. We will sit down with you, reconstruct your income and expenses for the missing years, and prepare accurate returns to bring you into compliance.

Our Recent Articles

-

What Actually Happens During an IRS Audit?

Receiving a notice in the mail from the Internal Revenue Service can be an intimidating experience for any taxpayer or business owner. However, an audit is not a criminal investigation; it is a routine review of your financial accounts and information to ensure that tax laws […]