What Actually Happens During an IRS Audit?

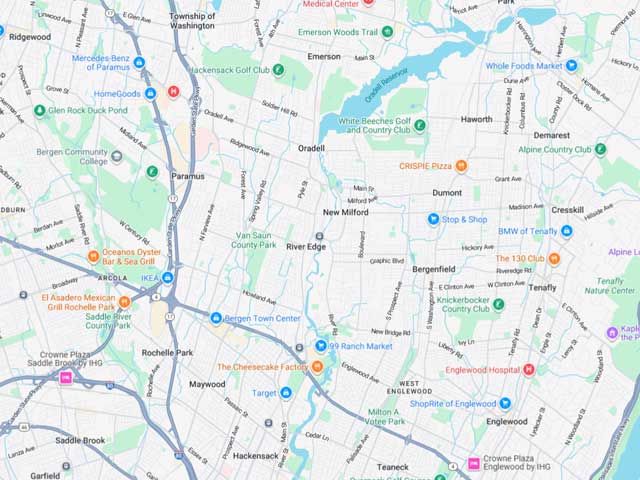

Receiving a notice in the mail from the Internal Revenue Service can be an intimidating experience for any taxpayer or business owner. However, an audit is not a criminal investigation; it is a routine review of your financial accounts and information to ensure that tax laws are being followed correctly and that the reported amount of tax is accurate. In Oradell, many professionals and small business owners face these inquiries due to the complexity of their returns. Understanding the process and maintaining a calm approach is the first step toward a successful resolution.

When the government decides to examine a return, it is usually because of a discrepancy or a "red flag" identified by automated systems. This is where professional accounting in Oradell becomes your greatest asset. By understanding the different types of audits and the specific steps involved, you can navigate the process without unnecessary stress.

For all your IRS audit questions and concerns, don't hesitate to give us a call today at 201-971-4110.

Understanding the Three Main Types of Audits

Not all audits are created equal. The Internal Revenue Service utilizes different methods depending on the complexity of the return and the specific issues they wish to verify. Recognizing which type of audit you are facing is crucial for preparing your defense.

- Correspondence Audit: This is the most common and least intrusive type of audit. It is conducted entirely through the mail. Typically, the agency is looking for documentation to support a specific item on your return, such as charitable donations or a simple individual tax return preparation error. You simply mail the requested records to the address provided.

- Office Audit: This requires you or your representative to visit a local government office. These are usually more comprehensive than mail audits and may focus on multiple areas of your tax services history. You will be asked to bring specific documents, such as bank statements, receipts, and ledgers, to be reviewed by an auditor in person.

- Field Audit: This is the most complex type of audit, where an agent visits your home or place of business. Field audits are often reserved for corporations, partnerships, or individuals with high net worth and complex business interests. The auditor will examine your records and may even tour your facility to verify your operations.

The Step-by-Step Process of an Examination

The IRS audit process follows a predictable timeline. It begins with an official notice. The Internal Revenue Service will never initiate an audit by telephone or email; they always send a formal letter via the United States Postal Service. This letter will outline the specific years being audited and the records you need to provide.

Once you receive the notice, the first step is to organize your records. You will need to gather all supporting documentation, including receipts, canceled checks, and bookkeeping records. This is also the time to seek IRS audit representation. Having a professional handle the communication ensures that you do not provide more information than is legally required, which could inadvertently open up other years for inspection.

The actual meeting or document review follows. The auditor will compare your records against the numbers reported on your return. They are looking for "tax compliance"—evidence that you have followed the law and can prove your deductions. If you are an investor in partnerships or hold foreign financial interests, this stage can be particularly technical, involving forms like the FBAR or Form 8938.

Why Professional Representation Is Essential

Many people believe they can handle an audit alone, especially if they have nothing to hide. However, the tax code is incredibly complex, and a single mistake in a conversation with an auditor can lead to a "residency/domicile audit" or a deeper look into your NJ BAIT filings. Professional tax advisory service providers understand the language of the auditors and the specific rights you have as a taxpayer.

A qualified representative can manage the entire flow of information. They act as a buffer between you and the government, ensuring that the audit stays focused on the original issues. This is especially important for start-ups or businesses involved in multi-state tax service, where the rules of one state might conflict with those of another. Your representative can also help negotiate installment plans or an offer in compromise if the audit results in a balance due that you cannot pay immediately.

Reaching a Resolution and Your Right to Appeal

At the conclusion of the audit, the agent will present their findings. There are generally three possible outcomes. The first is a "no change" audit, where the auditor accepts your return exactly as it was filed. This is the ideal result and validates the quality of your original accounting and preparation.

The second outcome is an "agreed" audit, where the auditor proposes changes and you agree with them. In this case, you will sign a report and pay any additional taxes, interest, or penalties. The third outcome is "disagreed," where you do not agree with the auditor's findings. You have the right to challenge these results through an administrative appeal or even in tax court. Having IRS representation is critical during an appeal, as it requires a high level of technical knowledge to argue against an auditor's interpretation of the law.

Ultimately, navigating an IRS audit or managing complex Business Tax Preparation does not have to be a source of constant anxiety. By maintaining meticulous Accounting records and understanding the specific requirements of your entity—whether it be Partnerships, S-Corps, or C-Corps—you position your business for long-term stability and growth. Proactive strategies like tax planning, utilizing NJ BAIT, and ensuring tax compliance are the most effective ways to protect your assets and provide peace of mind for your family and stakeholders.